Simplified vs. Regular Home Office Deduction for Sole Proprietors: How the Higher SALT Deduction Changes the Math

When you try to decide how to calculate the home office deduction, be sure to look under the roof of both options before letting either of them win you over.

Important Note: The simplified home office deduction is not available to S Corporation owners. This article is intended for sole proprietors who report business income on Schedule C.

Understanding Your Options

As a physician working from home, you have two methods to calculate your home office deduction: the simplified method and the actual expense method. While the simplified method appears straightforward on the surface, recent tax law changes—particularly the increase in SALT deduction limits—have shifted the calculation in ways that may surprise you.

The Simplified Method

The simplified method allows you to deduct $5 per square foot of your home office space, up to a maximum of 300 square feet (for a maximum deduction of $1,500). While this calculation is quick and easy, it's worth noting that this rate has never been adjusted for inflation since it was introduced in 2013, meaning its real value has eroded significantly over the past decade.

The Actual Expense Method

The actual expense method requires more record-keeping but allows you to deduct the business-use percentage of your actual home expenses. These expenses typically include (in rough order of magnitude):

Mortgage Interest (for homeowners) or Rent (for renters)

Property Taxes

Depreciation (only the building is depreciated, not the land value)

City/Municipal Utilities (water, sewer, trash collection, etc.)

Home or Renter's Insurance

Repairs and Maintenance

Cleaning

Home Security

A Real-World Example: Meet Dr. Taxwizard

Let's walk through a detailed example to see how these methods compare. Dr. Taxwizard is a physician who conducts telemedicine consultations from home. Here are her details:

She purchased home on 1/1/25 for $500,000 at 6% interest

Tax assessor allocates 70% of value to building ($350,000) and 30% to land ($150,000)

Total home size: 3,000 square feet

Home office size: 150 square feet (5% of total)

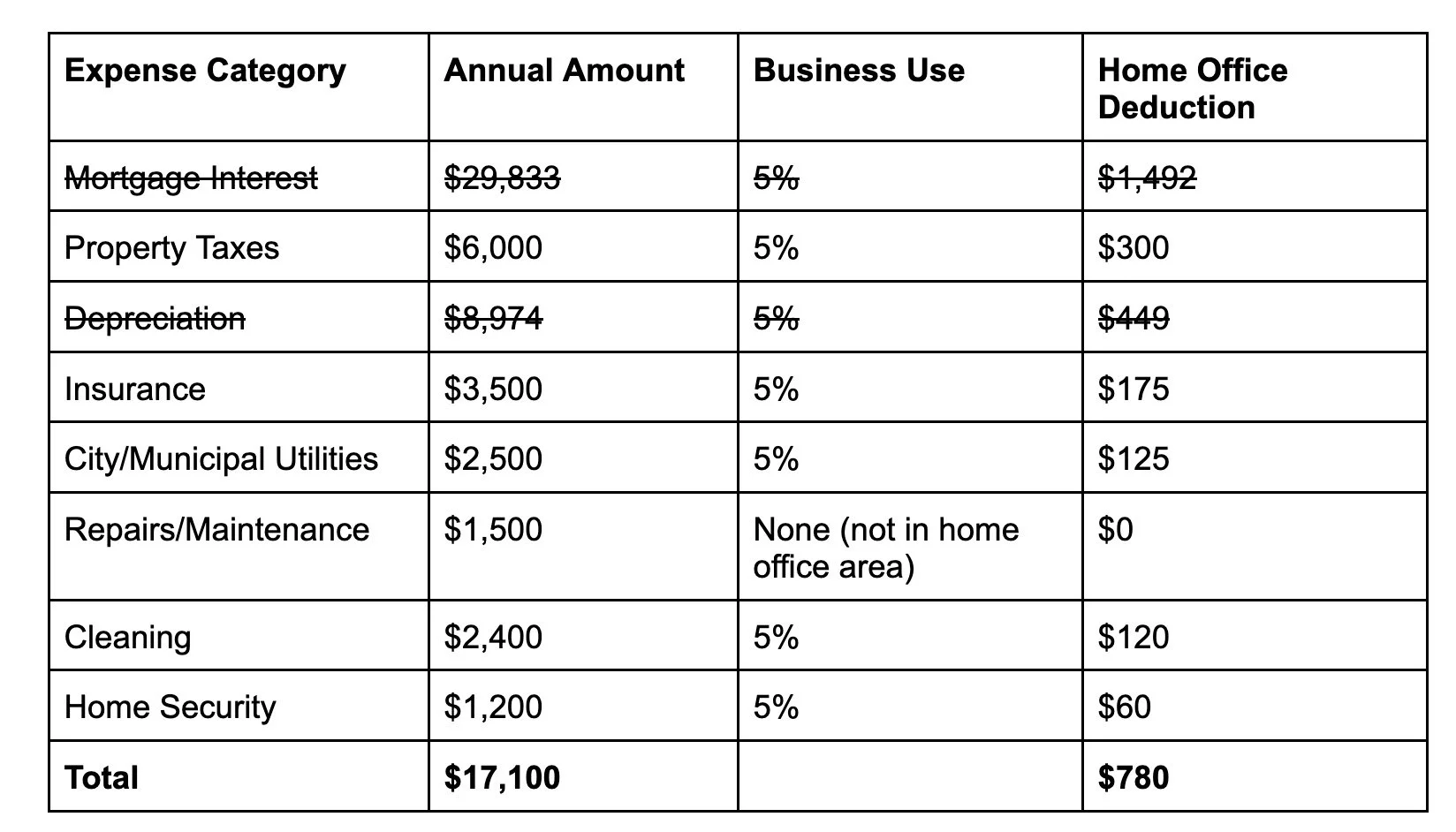

Calculating Actual Expenses

Here's Dr. Taxwizard's first-year home expense breakdown:

Note: Mortgage interest calculated using a standard amortization table. Building depreciation uses the residential rental property recovery period of 39 years ($350,000 ÷ 39 = $8,974 full-year depreciation).

Simplified Method: 150 sq ft × $5 = $750

At first glance, the actual expense method provides a deduction of $2,720 compared to just $750 for the simplified method—a clear winner, right? Not so fast.

The Plot Thickens: Itemized Deductions

Here's where the analysis gets interesting. If Dr. Taxwizard itemizes her deductions on Schedule A, she can already deduct her mortgage interest regardless of whether she takes the home office deduction.

One key point to understand: when using the simplified home office method, she doesn't need to apportion her mortgage interest—he can deduct 100% of it on Schedule A. On the other hand, if part of the mortgage interest is calculated and deducted as a home office expense, it can’t be deducted a second time on Schedule A.

Revised Calculation: Removing Mortgage Interest

The actual expense deduction drops to $1,229, but it's still better than the simplified method's $750.

The Depreciation Dilemma

There's another important consideration: depreciation recapture. If Dr. Taxwizard eventually sells her home in 5-10 years, she'll need to recapture the depreciation she claimed, which is taxed at a maximum rate of 25%. If her tax rate at the time of sale is the same as it is now (or higher), the depreciation deduction provides no long-term tax benefit—it merely defers taxes.

Further Revised Calculation: Removing Depreciation

Now the actual expense deduction has fallen to $780, still slightly better than the simplified method, but the gap has very much narrowed.

The Game-Changer: Expanded SALT Deductions

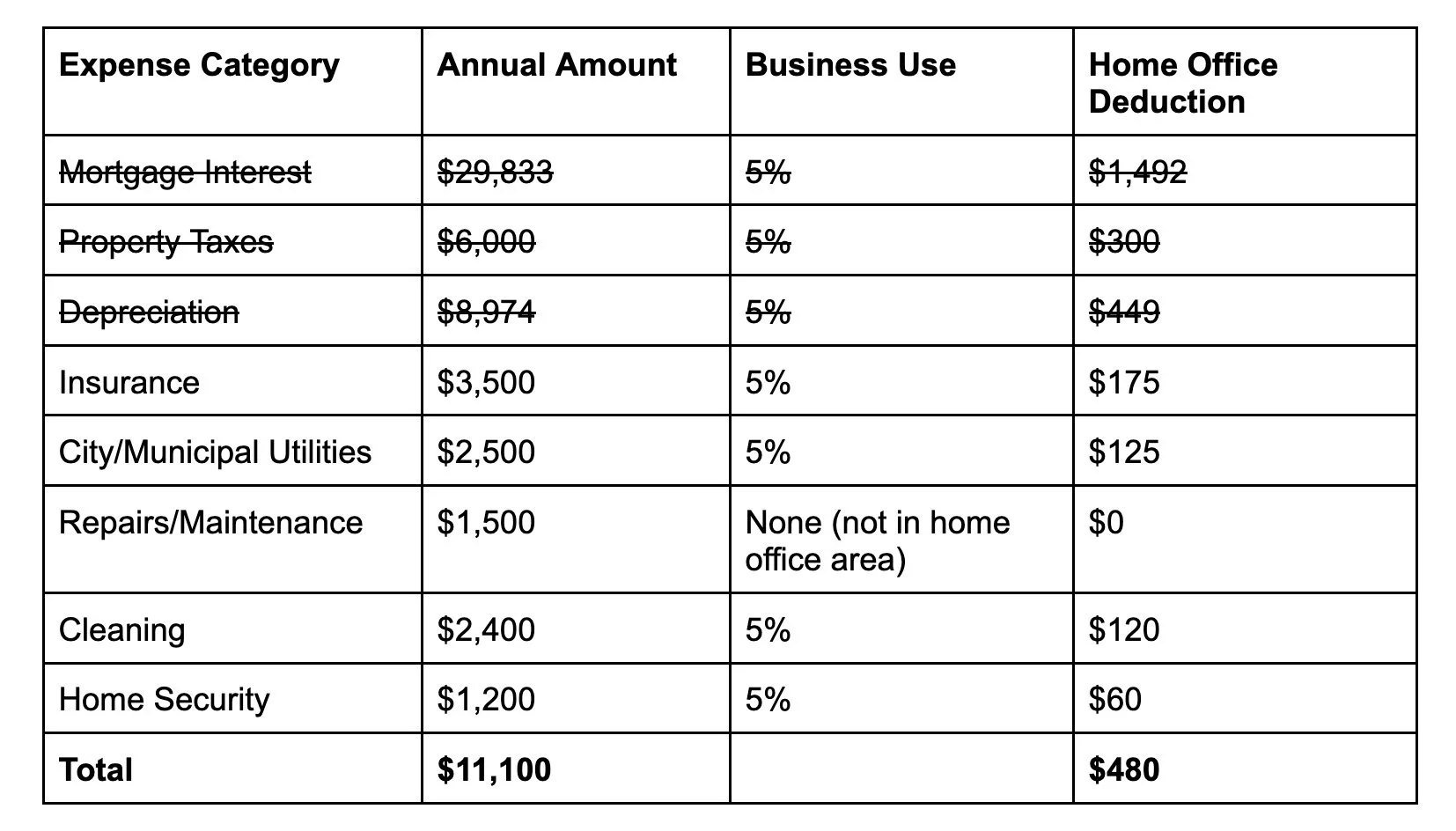

Here's where recent tax legislation fundamentally changes the equation. The One Big Beautiful Bill raised the SALT (State and Local Tax) deduction cap from $10,000 to $40,000 starting in 2025. This means far more taxpayers—especially high-earning professionals like physicians—can now deduct their full property tax on Schedule A.

If Dr. Taxwizard would deduct her property taxes on Schedule A anyway, there's no additional benefit to including them in the home office calculation.

Final Calculation: The Real Net Benefit

The result: After accounting for all these factors, the actual expense method provides a net benefit of only $480—compared to $750 for the simplified method. In this scenario, the simplified method is actually the better choice!

Additional Factors to Consider

Before making your final decision, consider these complicating factors that could shift the analysis:

Income Phase-Outs: What if Dr. Taxwizard's income is too high to deduct property taxes on Schedule A? The enhanced SALT deduction phases out starting at $500k of Adjusted Gross Income (AGI).

Mortgage Interest Limits: What if the outstanding mortgage principal exceeds $750,000, and not all mortgage interest can be deducted on Schedule A? In that case, she could deduct some extra interest through the home office, beyond what she could take on Schedule A alone.

Long-Term Tax Planning: What if Dr. Taxwizard doesn't sell the home, or sells it in retirement when her tax rate is much lower? In this case, depreciation recapture becomes less of a concern.

Above-the-Line vs. Below-the-Line: Home office expenses reduce Adjusted Gross Income (AGI), while itemized deductions don't. What if Dr. Taxwizard benefits more from reducing her AGI—perhaps to preserve the Child Tax Credit, qualify for other credits, or lower income-driven student loan payments?

If any of these special considerations apply to you, it's a good idea to engage in comprehensive tax planning to calculate their quantitative impact on your specific situation.

Conclusion

When you simply crunch the raw numbers, the actual expense method for home office expenses almost always produces a larger deduction than the $5 per square foot simplified calculation. The math seems straightforward: detailed tracking yields bigger tax savings.

However, before dismissing the simplified method completely, it's worth taking a deeper dive into your specific circumstances. The key insight is understanding that many home office expenses may already be deductible elsewhere on your tax return—particularly with the expanded SALT deduction limits now in effect. Additionally, depreciation recapture can significantly reduce the long-term benefit of the actualn expense method.

The simplified method isn't just about convenience—in many cases, especially for homeowners who itemize deductions, it may actually provide a better net tax benefit. Take the time to analyze your situation carefully, or work with a tax professional who can model both scenarios based on your complete financial picture.