Work Off the Beaten Path? Don’t Miss Out on These 7 State Rural Practice Credits

Now that it’s tax filing season, many taxpayers (especially self-employed ones) are looking at their draft 1040’s and feeling sticker shock. Unfortunately, your options for reducing your tax bill at this stage of the game are pretty limited, but it’s worth looking into whether you qualify for any unexpected tax credits at the federal, and especially the state level.

Gambling Losses, Taxes, and the One Big Beautiful Bill: When the House (and Uncle Sam) Always Wins

Gambling taxes have always been a little strange. If you’ve ever wondered why you can “break even” at the casino but still lose money after taxes, you’re not imagining things.

With the passage of the One Big Beautiful Bill (OBBBA), those rules have changed again—this time in a way that makes gambling less punitive for some taxpayers, but possibly slightly more so for others.

The $500,000 Home Sale Tax Break You Can Accidentally Throw Away

For most homeowners, the sale of a primary residence is one of the largest financial transactions they’ll ever make — and for many, it comes with one of the most generous tax benefits in the Internal Revenue Code.

That benefit is Section 121.

But Section 121 is also easy to misuse, misunderstand, or quietly forfeit.

Pass-Through Entity Tax After OBBBA: The Fine Print That Can Cost You

In Part I, we looked at how the Pass-Through Entity Tax (PTET) can still save taxpayers money — even after the OBBBA loosened the SALT deduction rules. For the right taxpayer, deducting state taxes at the entity level and reducing AGI can be a meaningful win.

But the PTET is not uniform across states, and it’s not free of tradeoffs.

In this post, we’ll look at how the PTET works differently depending on where you live, the multi-state complications that catch people off guard, and a handful of pitfalls that can quietly erode the benefit.

Pass-Through Entity Tax After OBBBA: Still Worth the Trouble?

This is the first of a two-part series on the Pass-Through Entity Tax (PTET).

Today, we’ll focus on how the PTET can still save you money, even after the OBBBA relaxed some of the restrictions on deducting state and local taxes. In next week’s post, we’ll look at the downsides — including situations where the PTET can actually cost you more than it saves.

Should You Eat Ice Cream for Breakfast? Deciding Whether to Claim Accelerated Depreciation

Most people agree that eating ice cream for breakfast is a questionable life choice.

And yet… sometimes it happens.

Accelerated depreciation falls into the same category. It can be delightful in the moment, but if you don’t understand what you’re doing (or why you’re doing it), you may regret it later.

Should Parents Open “Trump Accounts” for Their Kids — or Is This Just Another Account to Forget?

A new type of account is about to enter the personal finance ecosystem: Trump accounts. The name alone has generated plenty of attention, but for parents, the more important question is whether these accounts actually make sense as part of a broader financial plan.

Your Tax Year Is Bigger Than Your Calendar Year

A common misconception I see — even among highly educated professionals — is the belief that everything on your tax return has to happen between January 1st and December 31st.

It doesn’t.

For physicians, business owners, and self-employed professionals, this timing flexibility is often the key to making aggressive tax planning actually work in real life.

Let’s walk through the major deadlines — and what actually needs to happen by each one.

Should You Hire Your Spouse? (And Will the IRS Thank You or Audit You?)

Few tax questions sound as deceptively appealing as: “Should I just hire my spouse?”

At first glance, the idea seems clever. The work stays in the household, the money stays in the household — surely the tax benefits follow, too… right?

As with most clever ideas in tax planning, the answer is: sometimes, rarely, and only under the right circumstances. Hiring your spouse can be worthwhile, but it can also result in higher taxes, unnecessary payroll complexity, and zero net benefit.

Let’s walk through when this strategy makes sense, when it doesn’t, and what you should consider before adding your spouse to payroll.

Don’t Jump the Gun: Why You Should Wait Before Making 401(k) Employer Contributions

There is something irresistibly satisfying about funding a retirement account early — the same kind of joy you get from clearing your inbox, finishing charting before noon, or finding out your prior authorization actually went through. But when it comes to 401(k) employer contributions, going too early can create a tax mess that is far more painful than waiting until January.

Let’s walk through why timing matters more than you think — and why many physicians and small business owners should hold off on employer contributions until the year is officially over.

1099s Made Simple: Who Gets One, Who Doesn’t, and How to Avoid IRS Headaches

Every January, business owners across the country are reminded that with great power (1099 income) comes great responsibility (issuing 1099s to others).

If you pay contractors for services, the IRS expects you to report those payments — and they’ve built several traps that catch people who don’t understand the rules.

Why Your Marginal Tax Rate Isn’t 24%

Most people quote their marginal tax rate from the federal tax brackets. But your true marginal rate is the sum of several layers of taxes—federal, state, payroll, and sometimes even city. And your marginal rate can differ depending on whether the income is earned (salary or self-employment), passive (investments), or from a business.

Should Solopreneurs Add a Cash Balance Plan?

If you’ve been maxing out your Solo 401(k) and still feel your tax bill looks like it’s on steroids, there’s another tool you might not have considered: the Cash Balance Plan.

It’s not exactly a household name — even among financial pros — but for the right business owner, it can be one of the most powerful ways to save more for retirement while trimming down what you owe Uncle Sam.

Paging Dr. Double Tax: When Two States Want a Cut of Your Income

When you’re a physician, consultant, or small business owner with income that crosses state lines, the rules start to feel like an interstate turf war.

Each state wants its cut — and unfortunately, they’re not always good at sharing.

Don’t Fall for the “Important New Business Documents” Trap

Starting a new business feels exciting — until the junk mail starts rolling in.

If you’ve recently formed an LLC or corporation, there’s a good chance you’ll receive an official-looking letter like this one. It uses government-style fonts, state seals, and urgent language about “important documents” and “pending filings.” It even includes a due date and a fee total

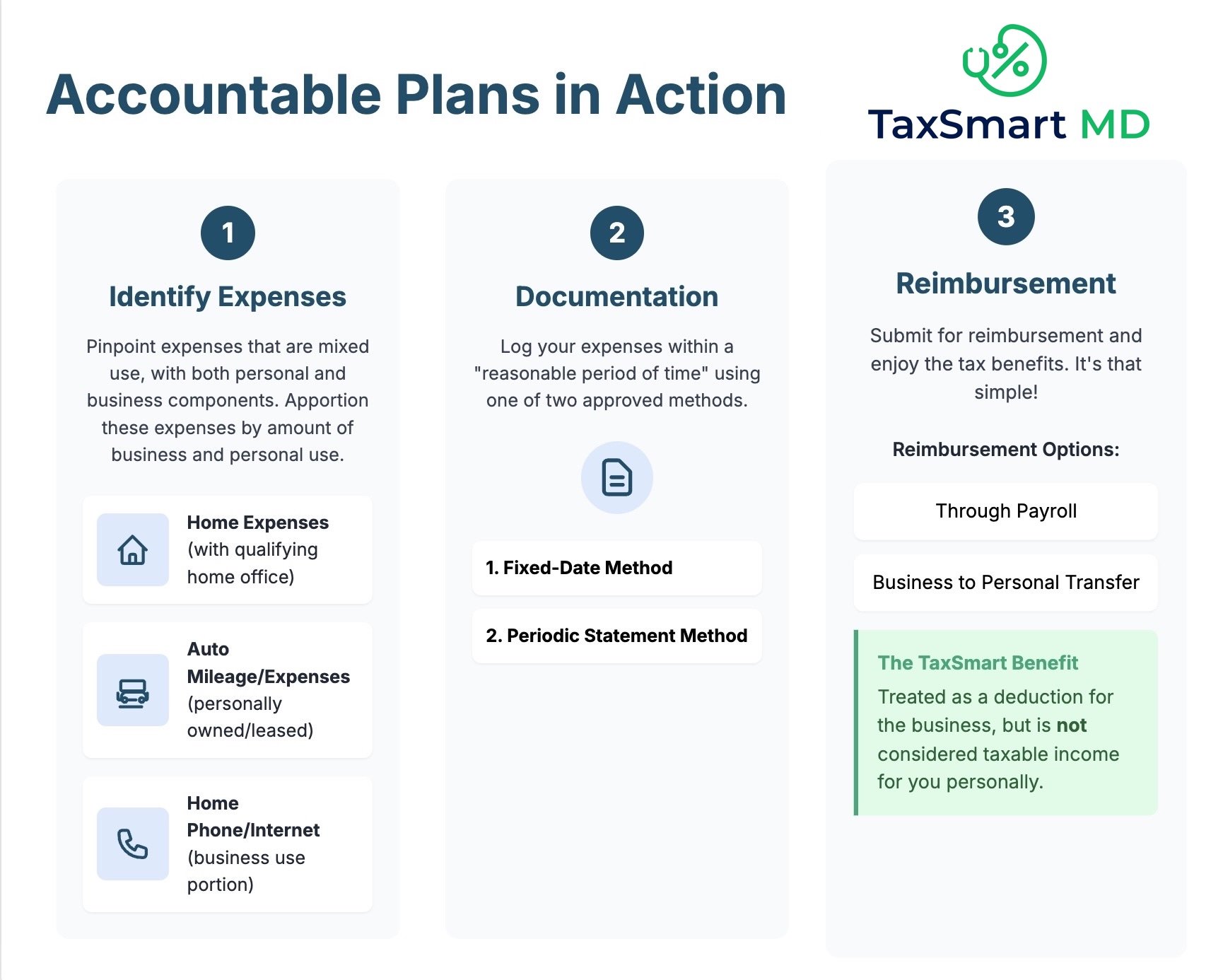

The Accountable Plan: The S-Corp Owner’s Secret Weapon for Tax-Free Reimbursements

If you run your business through an S Corporation, you’ve probably noticed that some expenses blur the line between “business” and “personal.”

That’s exactly where an accountable plan comes in — an IRS-approved system that lets your S Corp reimburse you for mixed-use business expenses without those reimbursements being treated as taxable income or wages.

Simplified vs. Regular Home Office Deduction for Sole Proprietors: How the Higher SALT Deduction Changes the Math

As a physician working from home, you have two methods to calculate your home office deduction: the simplified method and the actual expense method. While the simplified method appears straightforward on the surface, recent tax law changes—particularly the increase in SALT deduction limits—have shifted the calculation in ways that may surprise you.

When an S Corporation Isn’t the Right Prescription for Physicians

If you’ve spent more than ten minutes in a Facebook group for self-employed physicians, you’ve probably seen this refrain:

“Form an S Corporation — it’ll save you a fortune in taxes!”

Like most good tax advice, it’s sometimes true, but dangerously incomplete.

Eight Things You Probably Didn’t Know You Could Do With Your IRS Account - A Walkthrough

If you haven’t created an IRS account, or haven’t accessed it in a long time, there are many reasons why it is worth your time to log in and discover its features and functionality for yourself.

The Self-Employed Physicians’ Guide to the One Big Beautiful Bill, Part IV: What’s In It For Parents?

The costs of raising a family are a critical part of the financial picture for young couples and single parents. Considering that over 100 million households in the United States have a child under 18, it is hardly surprising that the One Big Beautiful Bill Act (OBBBA) contained several provisions that provide tax breaks to parents. If you have kids or are considering starting a family in the next few years, it’s worth knowing how you can make the most of these rules.