The Self-Employed Physicians’ Guide to the One Big Beautiful Bill, Part IV: What’s In It For Parents?

Tax deductions are exciting stuff, but that doesn’t mean you should upend your life plans to capitalize on them.

The costs of raising a family are a critical part of the financial picture for young couples and single parents. Considering that over 100 million households in the United States have a child under 18, it is hardly surprising that the One Big Beautiful Bill Act (OBBBA) contained several provisions that provide tax breaks to parents. If you have kids or are considering starting a family in the next few years, it’s worth knowing how you can make the most of these rules.

Parent Tax Break #1: Increased Child Tax Credit

The Child Tax Credit is very popular (CTC) with taxpayers, and for good reason. Prior to the passage of the OBBBA, it allowed parents to take a credit of up to $2,000 for every child under 17 (there is a separate credit available after children reach age 17).

Starting this year (2025), the maximum increases to $2,200 per child, and in future years, this will be indexed to inflation. The credit begins to phase out for single/MFS taxpayers with an income over $200,000 and MFJ taxpayers with income over $400,000 (if you are in this phase out range, your marginal tax rate increases by 5%). You might think that this phase out range will also rise with inflation, but sadly that isn’t the case (apparently, inflation isn’t an economic phenomenon when your income is in the six figure range).

The CTC was actually quite a bit higher during the pandemic, but this allowance expired at the end of 2021. Fortunately, the new credit of $2,200, while less generous, is “permanent.”

Parent Tax Break #2: Higher Dependent Care FSA Contribution Limits

Currently, taxpayers can deduct up to $5,000 ($2,500 if married and filing separately) in contributions to a Dependent Care Flexible Spending Account (DCFSA).

These limits increase by 50% to $7,500, and $3,750 for spouses who file separately. This change takes effect in 2026.

Conceivably, couples with a marginal tax rate over 40% could save over $1,000 in taxes with this change.

Parent Tax Break #3: Expansion of 529 Eligible Expenses

Prior to the passage of the OBBBA, three major tax bills in the last ten years expanded the list of eligible expenses for 529 plans.

First, the Tax Cuts and Jobs Act (TCJA) contained a provision allowing up to $10,000 per year to go to tuition for K-12 education.

Next, the SECURE Act, passed in 2019, allowed up to $10,000 to be used for qualified student loan payments.

More recently, the SECURE 2.0 Act, passed in 2022, permits taxpayers to roll over $35,000 from a 529 plan into a Roth IRA over the course of a beneficiary’s lifetime, but the account must be open for at least 15 years.

Finally, the OBBBA allows parents to withdraw money from 529 accounts to cover numerous other K-12 educational expenses, beyond tuition. These include, but are not limited to, the cost of books, tutoring, standardized testing, and college classes taken in high school. The effective date is 7/4/2025 (when the OBBBA was signed into law).

Additionally, the new bill increases the eligible K-12 tuition to $20,000 annually, but this takes effect in 2026.

There is an enormous caveat to all of the prior 529 provisions. The federal rules allow for state 529 plans to include these as qualified expenses, but states can choose to conform or not conform to these federal rules. You will benefit by checking your own state’s rules (or asking your tax advisor about them) before banking on tax benefits from a 529 plan.

Lastly, the OBBBA, as of 7/4/2025, allows you to take qualified withdrawals from a 529 plan to cover the cost of certain postsecondary credentials. I don’t expect to see many parents using a 529 for their children on this, but for physicians who would like to explore other academic or professional interests, it could be a modest additional tax break. The credentials do need to be recognized by an accrediting body, however, so before you dump $50,000 on the Sidewalk Chalk Artist certificate from the Boardwalk College of Pavement Expression, it would behoove you to make sure the certificate is recognized as more than just a mechanism of separating your money from your wallet.

Savvy readers may wonder if they should use a 529 for these kinds of expenses if they also qualify to be deducted as a business expense. This is an excellent question, and the answer is they shouldn’t if the expenses are deductible by your business. In other words, you can’t double dip. However, the guidelines from the IRS state that educational expenses that qualify a taxpayer for a new trade or business are not deductible, while those used to maintain or improve skills in a current trade or business are deductible. In other words, it’s pretty gray, but the tax courts have been fairly conservative on allowing this deduction when cases pertaining to it have appeared on their dockets.

If you are going for a new credential in a field unrelated to medicine, most likely, it won’t hold up as a business deduction for those reasons. That is the situation where using a 529 could be useful.

With all that being said, the tax benefits of 529 plans are real but fairly modest overall, and there are penalties for withdrawals used for nonqualifying purposes. For this reason, I wouldn’t recommend making large contributions to them for yourself, unless you have a qualified program in mind.

Parent Tax Break #4: Trump Accounts

Most parents who are saving for retirement and their children’s education have a slew of accounts to understand and manage - 401(k)’s, IRA’s, 403(b)’s, 457(b)’s, HSA’s, 529’s, UTMA’s, brokerage accounts (I won’t mention Coverdell ESA’s or 529 ABLE plans, though they apply to a small subset of families). Naturally, Congress concluded that you want and need another account to consider.

Sarcasm aside, the OBBBA specifies that Trump Accounts will be created for children born between 1/1/2025 and 12/31/2028, and that $1,000 will be deposited to these accounts by the government. The first contributions will not take place until July 2026. Parents and other individuals can contribute up to $5,000 per year (indexed to inflation) to the account.

The OBBBA says the money can’t be withdrawn prior to the beneficiary’s 18th birthday, but the law itself is unclear about the distribution rules afterward. This is expected to be clarified in future guidance from the IRS.

Overall, it’s unclear that these accounts will have a place for most families. Unlike 529 plans, earnings from the account are taxed on withdrawal, regardless of whether they are used for education or another purpose. The relevance comes mainly from the $1,000 deposits available for children born through the end of 2028. Five years from now, it will be interesting to see what happens to birth rates in the US between December 2028 and January 2029.

Parent Tax Break #5: Refundable Adoption Credit

If you’re thinking of adopting, bravo to you for giving a child the gift of family. To offset the cost of adoption expenses, there is a tax credit of up to $17,280 available in 2025, indexed for inflation. There is an income phase out that kicks in at around $250k, which unfortunately renders many physicians ineligible.

The primary change with the OBBBA is that up to $5,000 of this credit becomes refundable. So, if your tax liability is $12,280 or higher, you can still claim the full tax credit. If your tax liability is less than that, your tax liability will go down to zero, and $5,000 will be refunded to you (along with any withholdings and other refundable credits, such as the CTC).

Summary

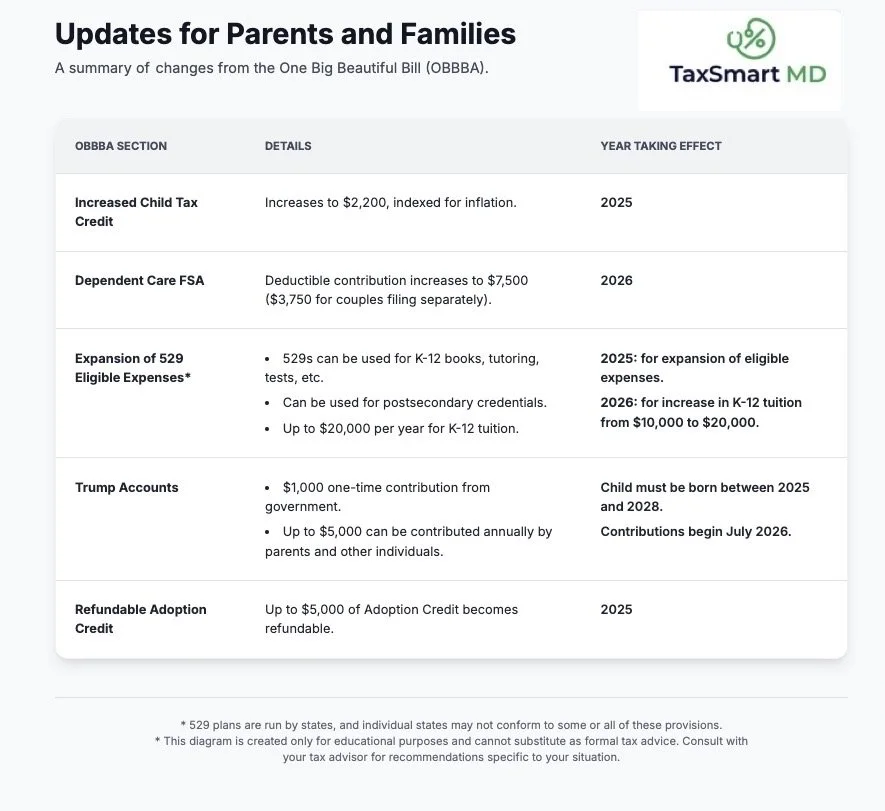

The OBBBA includes several changes benefiting parents and families; individually, they are fairly minor, but in aggregate, I think they are significant. The following diagram summarizes the rules and when each of them takes effect.