Eight Things You Probably Didn’t Know You Could Do With Your IRS Account - A Walkthrough

IRS Accounts are mega-fun, but everything has a time and place.

If you haven’t created an IRS account, or haven’t accessed it in a long time, there are many reasons why it is worth your time to log in and discover its features and functionality for yourself.

Generally, the benefits are threefold:

A. It’s an easy-to-access tool for finding important tax records.

B. It provides context and clarity if you receive a notice from the IRS.

C. It enhances understanding of our tax system and the IRS’ role in administering it.

While the site is helpful, how to get around and use it is far from intuitive. I created this guide to help my clients and other taxpayers learn how to use their account to their advantage.

1. View your Account Balance

Your account balance with the IRS simply describes how much the IRS believes you owe them, or how much they owe you.

Most people don’t have a major need to check this, but if you’ve made a payment to the IRS, or you received a notice and were able to resolve it, this is where you would go to see if the adjustment has taken place.

Here’s where you go to access your account balance:

And here’s what it looks like after you navigate to the account balance section:

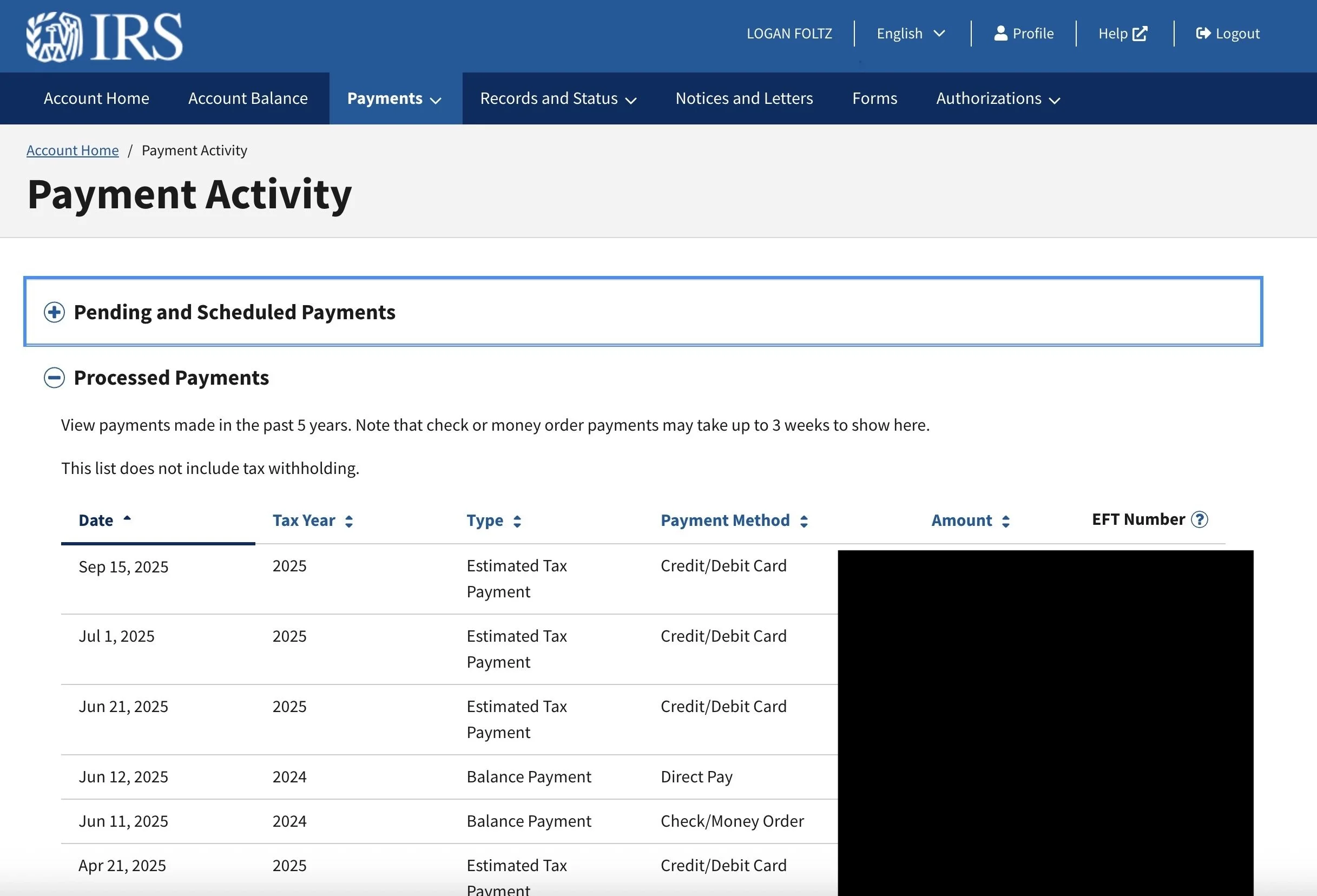

2. View your Record of Tax Payments

If you can’t remember whether you made your estimated tax payments, payments with your tax return, or if you can’t remember the amounts of these payments, you can easily find this information in your IRS account.

Here’s where you navigate to locate the payment record:

And here’s what a record of payment activity looks like:

The “amount” (which I’ve removed from the screenshot) is the most important information, but the tax year is also critical. As a tax professional, this is what I review to ensure I document federal estimated payments accurately.

3. Review your Information Returns

Through your IRS account, you can see every Form 1099, Form W2, and other forms (5498, 1095-A) the IRS has received. So, if you’ve lost your paper copies of these or can’t access them through the online systems, you can locate the forms here.

Here is how you navigate to this section:

And here is how it looks:

Usually, these do not show up in your IRS account until after the tax deadline. If you file an extension, you can review this before you file the return to make sure you captured everything (sometimes, forms get lost in the mail, or you forget about accounts).

Obviously, if the IRS received one of these forms, and you didn’t report it on your tax return, your chances of getting audited will be higher.

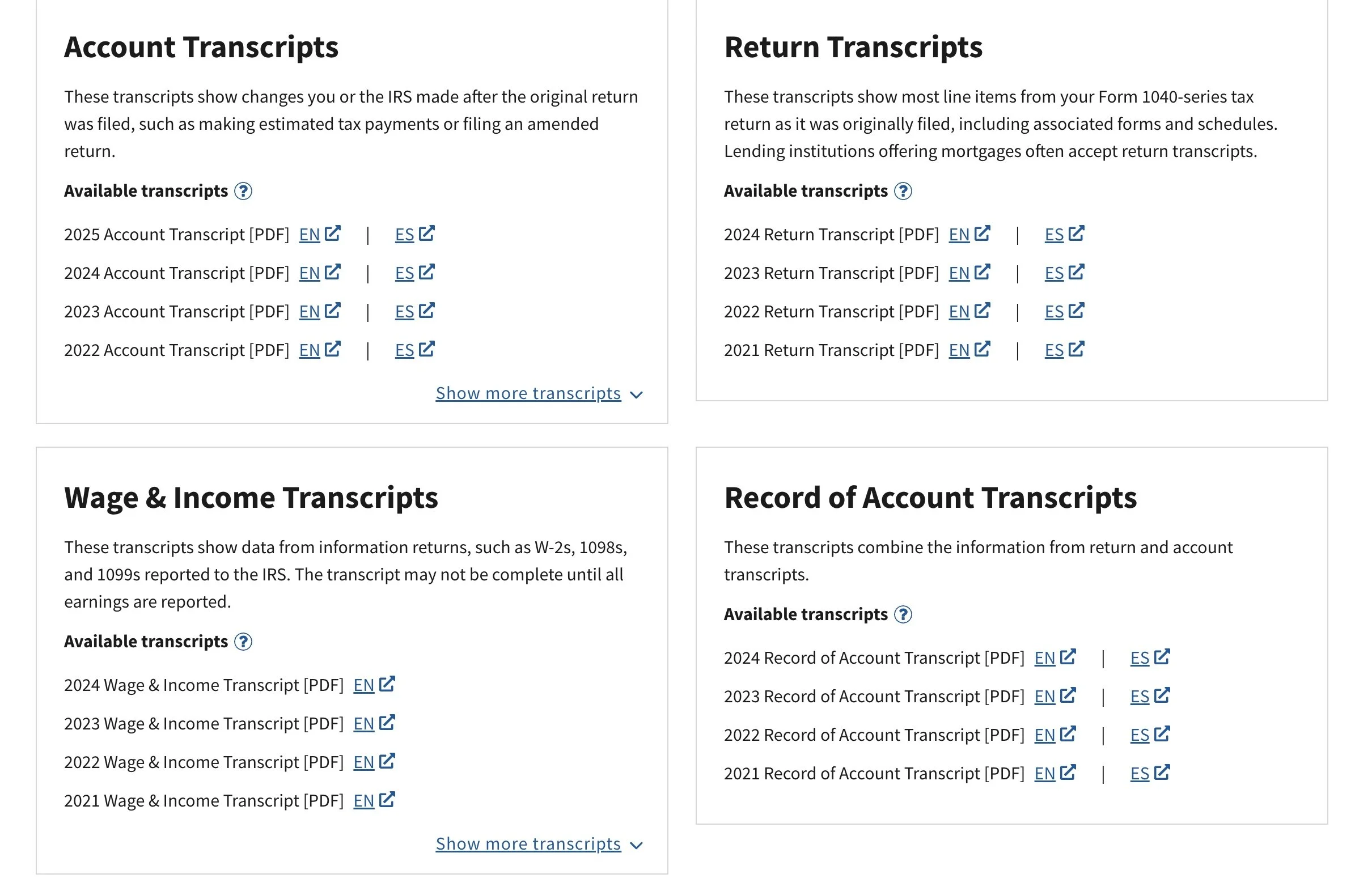

4. Access Your Transcripts

If you receive a notice from the IRS and can’t make sense of why they say you owe them money, or are due a refund, the transcripts are often the first place to look to find more details on the adjustments that were made.

Here is how you navigate to this section:

And here is what the next screen looks like:

You can also check out the “tax compliance report” if you like. Most people won’t need this, but it may be requested if you apply for federal employment or security clearance.

Next, this is what you see after you click “view transcripts:”

As you can see, there are four different kinds of transcripts you can access. Here is a quick rundown of what information you might find in each of these:

A. Account Transcript: This shows a record of the transactions in your tax account related to that tax year. Mine shows dates of payments, dates of filing of my tax return and the extension, and records of withholding. This is generally the best transcript for deciphering IRS adjustments.

B. Return Transcript: This is a record of tax returns that you filed, or were filed on your behalf. The form looks different and does not contain all the worksheets you might see in the actual tax return (1040) you filed, so if you need to refer to a prior year return, it’s preferable to see the original forms.

C. Wage and Income Transcripts: This is another way to see all the information returns (W2, 1099, etc) the IRS has on file. I also see K1’s in this section, which I do not see in the Information Returns section I mentioned earlier.

D. Record of Account Transcripts: As best I can tell, this is a combination of your account and return transcripts.

5. Check the Status of your Refund and Amended Return

If you’re wondering how to check the status of your refund or amended return, you can see this in your IRS account. Here is how you navigate to this section:

6. Check your Audit Status

Hopefully, you never have a reason to check this section, but if you are under audit, you can view the current status in this section:

If you want peace of mind, you can click on that section. This is what you will hopefully see afterward:

7. View Notices

Nobody likes to get a notice from the IRS, but they are extremely common, and usually they can be resolved without the IRS taking punitive action. Here is a screenshot showing what it looks like if you have an IRS notice. If you see the IRS notice on your account, you can shred the paper version you received in the mail.

Yes, even tax professionals get IRS notices. Since you are probably curious, mine said I owed the IRS $9. This was because I mislabeled the original payment when it was made online (I figured this out by looking at my transcript and payment record in my account).

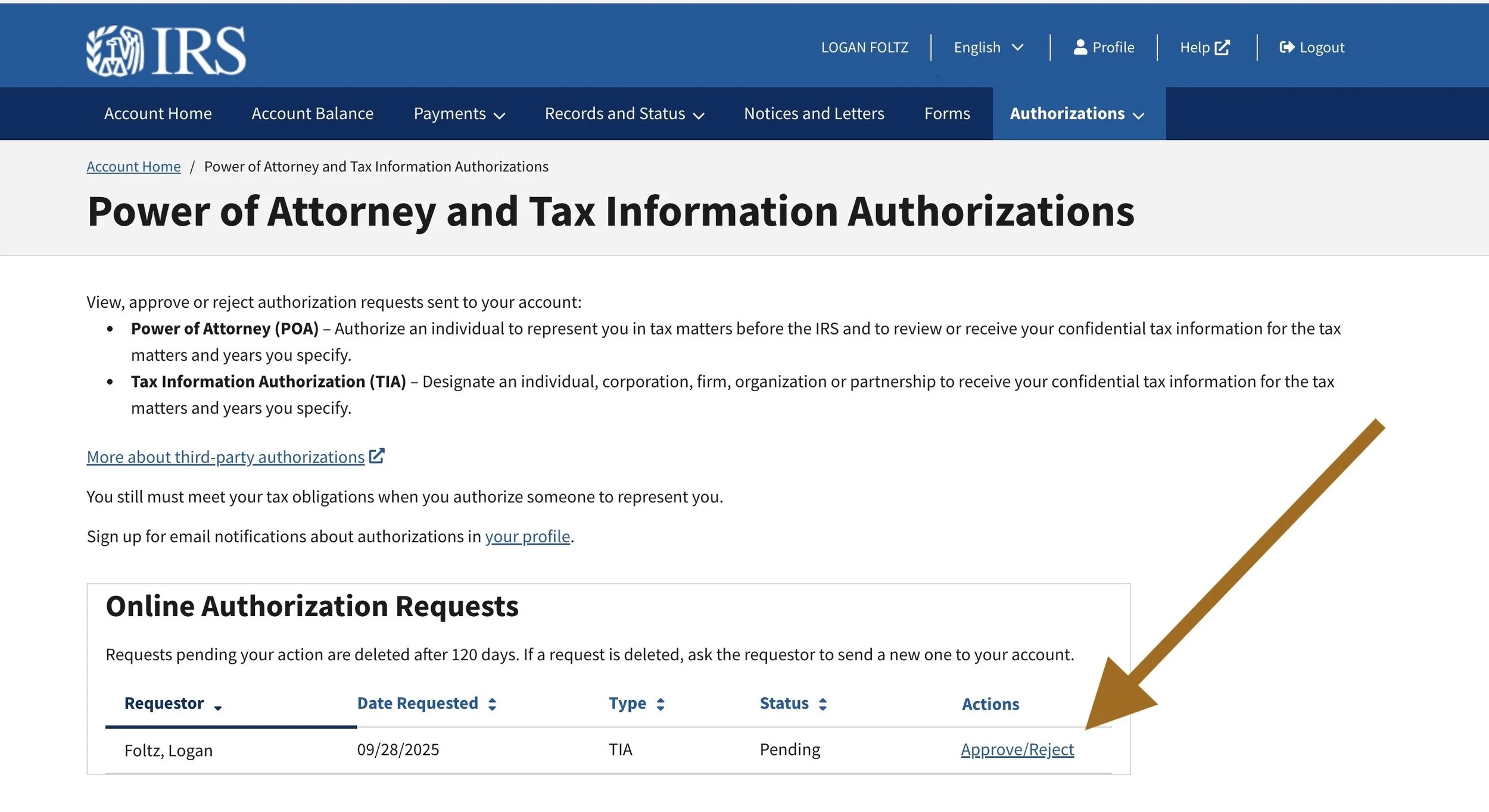

8. Grant Authorization to your Tax Professional:

Your tax professional can request for you to approve Power of Attorney or Tax Information Authorization (TIA). The Power of Attorney allows the tax pro to contact the IRS and represent you if you need help resolving an issue. The Tax Information Authorization, if approved by the taxpayer, provides the tax professional with access to some, but not all, of the items in your IRS account. I routinely request TIA’s from my clients in the process of onboarding. The most important reason is so that I can see their record of payments without asking them to upload confirmations. This is essential for planning and accurate tax return preparation.

The following screenshot shows what it looks like if you have a request to approve one of these authorizations:

First, go here:

Then, you’ll see this:

Conclusion:

While the IRS is in many ways an opaque and mysterious government entity, and their customer service leaves plenty to be desired, taxpayers can make use of their online account to bridge the gap between how they understand their taxes and how the IRS processes their taxes. Hopefully you’ve learned some useful tidbits from this walkthrough. My goal is to impart readers with knowledge and agency, and if this helps you make sense of your taxes, I believe this guide will have served its purpose.