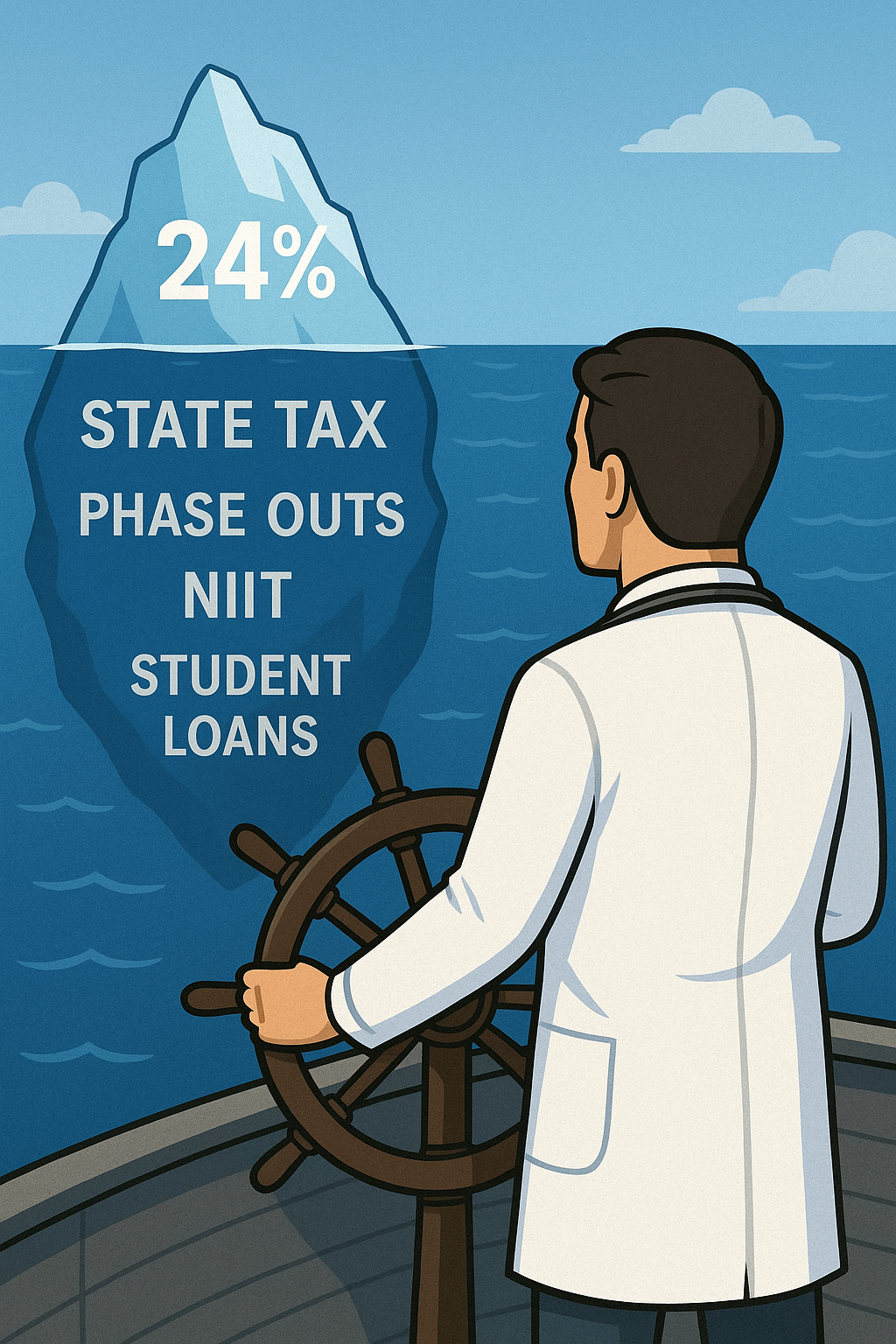

Why Your Marginal Tax Rate Isn’t 24%

Most people quote their marginal tax rate from the federal tax brackets. But your true marginal rate is the sum of several layers of taxes—federal, state, payroll, and sometimes even city. And your marginal rate can differ depending on whether the income is earned (salary or self-employment), passive (investments), or from a business.

Should Solopreneurs Add a Cash Balance Plan?

If you’ve been maxing out your Solo 401(k) and still feel your tax bill looks like it’s on steroids, there’s another tool you might not have considered: the Cash Balance Plan.

It’s not exactly a household name — even among financial pros — but for the right business owner, it can be one of the most powerful ways to save more for retirement while trimming down what you owe Uncle Sam.

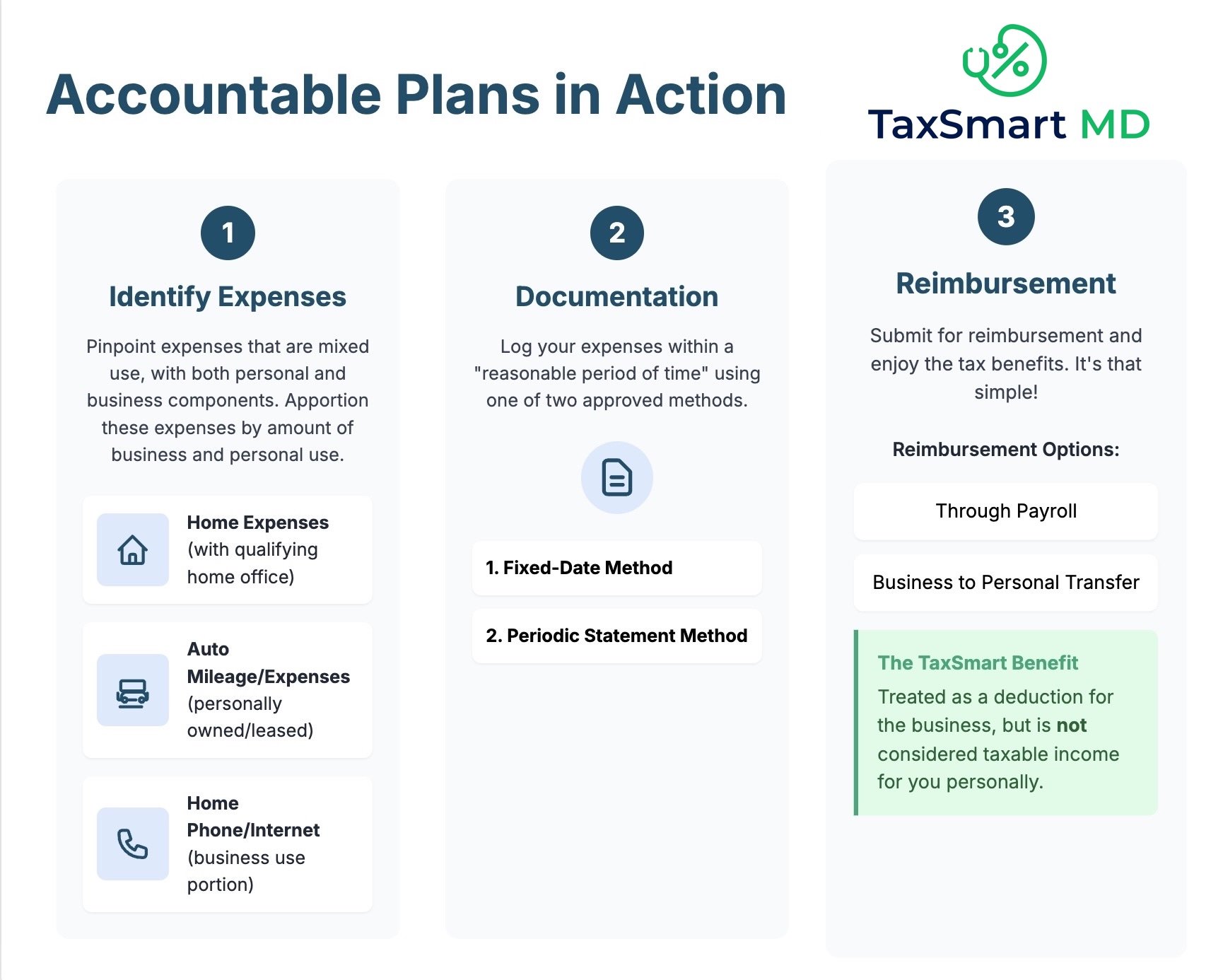

The Accountable Plan: The S-Corp Owner’s Secret Weapon for Tax-Free Reimbursements

If you run your business through an S Corporation, you’ve probably noticed that some expenses blur the line between “business” and “personal.”

That’s exactly where an accountable plan comes in — an IRS-approved system that lets your S Corp reimburse you for mixed-use business expenses without those reimbursements being treated as taxable income or wages.

When an S Corporation Isn’t the Right Prescription for Physicians

If you’ve spent more than ten minutes in a Facebook group for self-employed physicians, you’ve probably seen this refrain:

“Form an S Corporation — it’ll save you a fortune in taxes!”

Like most good tax advice, it’s sometimes true, but dangerously incomplete.

The Self-Employed Physicians’ Guide to the One Big Beautiful Bill, Part IV: What’s In It For Parents?

The costs of raising a family are a critical part of the financial picture for young couples and single parents. Considering that over 100 million households in the United States have a child under 18, it is hardly surprising that the One Big Beautiful Bill Act (OBBBA) contained several provisions that provide tax breaks to parents. If you have kids or are considering starting a family in the next few years, it’s worth knowing how you can make the most of these rules.

The Self-Employed Physicians’ Guide to the OBBBA Part III: Charitable Donations

In other words, the changes to the SALT deduction by themselves change how we look at charitable donations. What’s more, the OBBBA has introduced a couple of fairly minor changes to how charitable donations are deducted. Importantly, these take effect in 2026 (the change to the SALT deduction takes effect in 2025). Because they are both calculated on the same schedule of the tax return, and the total is compared with the standard deduction, there is significant interplay between them in a holistic tax plan that optimizes for 2025 and future years.

The Self-Employed Physicians’ Guide to the OBBBA Part II: Changes to the QBI Deduction

The new tax bill introduced some changes to the QBI deduction (also known as the Section 199a deduction). Taxpayers who work in service professions, such as medicine, have always been eligible for this deduction since it was enacted in the Tax Cuts and Jobs Act (TCJA).

The Self-Employed Physicians’ Guide to the OBBBA Part I: The New $40k SALT Cap Deduction

For most taxpayers, the largest tax obligation they pay at the state/local level is their state income tax.

…Ready for It? A New Tax Era for Kelce and Swift

Taylor Swift and Travis Kelce happily announced their engagement this week. If you are also considering a walk down the aisle, read on to learn how getting hitched can result in big changes in your tax return.

Navigating the Sunset: Expiring Energy Credits Under the One Big Beautiful Bill Act

The clean energy landscape underwent a major shift with the enactment of the "One Big Beautiful Bill Act" (OBBBA) on July 4, 2025….