The Self-Employed Physicians’ Guide to the OBBBA Part I: The New $40k SALT Cap Deduction

You shouldn’t be sluggish in adapting to changes in Tax Law, and neither should your tax professional.

For anyone who has spent their summer on a desert island, something called the One Big Beautiful Bill made the news recently. No, I’m not talking about Bill Gates, Bill Nye the Science Guy, Bill Clinton, or even Bill Cosby. This was legislation passed by Congress and signed into law, going by the official title of The One Big Beautiful Bill Act (OBBBA). It dramatically changes personal income taxes, at least for the next several years.

The OBBBA is approximately 870 pages, and I won’t begin to cover all the changes it creates in our Tax Code. Understandably, the effect on the deduction for State and Local Taxes (SALT, which is one of the few items that becomes active in 2025) has been among the most frequently discussed provisions of the bill. Most of my tax clients in 2024 were limited to taking a $10,000 deduction for SALT ($5,000 if married filing separately), which was a cap imposed by the Tax Cuts and Jobs Act (TCJA). As a result, the number of taxpayers taking itemized deductions dropped from 31% to 9% in just a few years.

For several reasons, I don’t expect that this number will go back to 31%. For one, while the change in SALT means larger potential itemized deductions, the standard deduction is still much higher than before the TCJA was enacted. Second, while the SALT deduction was unlimited before the TCJA, the OBBA leaves a (much higher) cap in place, and taxpayers’ eligibility may be limited if they exceed certain income thresholds.

With that broad overview, let’s dig into the details of the new SALT deduction.

What are deductible State and Local Taxes (SALT)?

For most taxpayers, the largest tax obligation they pay at the state/local level is their state income tax. Some cities and municipalities also impose a local income tax. These are all potentially included in the list of taxes that can be deducted on the federal tax return. This covers estimated payments and withholdings from a W2 job, and any tax payments made when a return was filed.

You also have the option to deduct sales taxes instead of income tax payments. No, you don’t need to add the totals on your receipts. You can use the sales tax calculator instead. This is most useful for taxpayers in states with no income taxes, such as Florida and Texas.

In addition to income taxes or sales taxes, taxpayers can deduct property taxes paid for real estate and other property, such as vehicles.

If you’re in a state with an average 5% income tax, $200,000 of income is enough to reach a tax liability of $10,000 (in addition to any property taxes you pay). This illustrates how the $10,000 cap was painful for many physicians and their families.

Major changes in the OBBBA

Instead of $10,000, the new maximum is $40,000 (adjusted annually by 1% per year), but this comes with important caveats. It depends heavily on your Modified Adjusted Gross Income (MAGI).

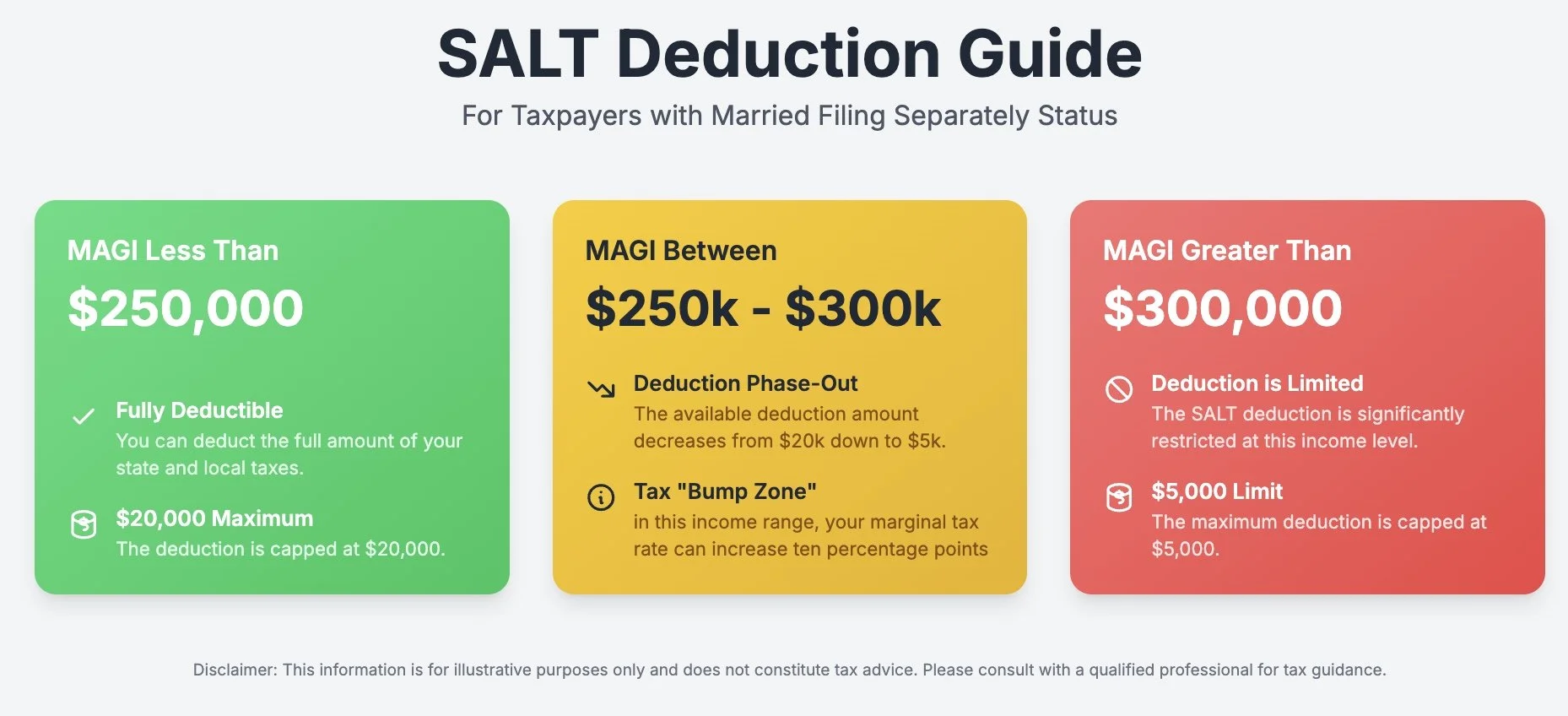

The following infographics illustrate how this works for Single and Married Taxpayers.

How This Impacts Tax Planning

The first thing I want to point out is that you want to be in the green zone to get the maximum SALT deduction. However, your marginal tax rate increases quite significantly (about ten points) once your income goes above $500k (single/MFJ). After your income goes over $600k, you will still hit the 35% and 37% thresholds of the highest brackets, but at least your SALT deduction will not decrease any further below $10,000.

Practically, this means that it makes sense to be most aggressive in utilizing tax strategies that lower AGI if you are in this middle range. What could this look like? Well, it could mean taking accelerated depreciation on medical equipment. It would also be a good time to contribute as much to pre-tax retirement accounts as possible. If you have an S Corporation, it would be more incentive to take advantage of your state’s Pass Through Entity Tax (PTET) provision, if available. You could hire out help or even hire family members (thereby creating an expense for you, and income for them). This is the bread and butter of topics I cover with clients in tax planning meetings.

Second, this can impact how we approach itemized deductions generally. Charitable donations are another special category of itemized deductions impacted by the OBBBA, so I will save those for a future post. But taxpayers do have some control over how much mortgage interest they pay. For one thing, they can decide when to take out a mortgage, or when to take out a HELOC if they desire to renovate or improve their home. They can also decide if they want to make their payments on a standard schedule, or pay off their home sooner.

Imagine a couple whose income increases from $490,000 in 2025 to $610,000 in 2026. Their SALT deduction could decrease from $40,000 in 2025 to $10,000 in 2026. Their standard deduction is $31,500. They will likely benefit from taking out a mortgage at the end of 2025, rather than 2026. In 2025, they can deduct all of the mortgage interest they pay, including points. In 2026, the first $21,500 of mortgage interest would not help them, since this only gets them to the standard deduction.

What’s more, the enhanced SALT deduction is scheduled to sunset after 2029, and the cap will revert to $10,000. Conceivably, then a couple could go from taking a high SALT deduction in 2029 to a $10,000 SALT deduction in 2030. That might be a good time to start paying off their home, since a good portion of their mortgage interest ($21,500+, adjusted for inflation) will no longer be deductible.

You may have noticed that the prior examples apply to couples, rather than single people. This is because the new SALT deduction has the same maximum and income eligibility for both singles and couples. For more about potential marriage penalties, see this article.

Since it is one of my favorite tax strategies, I want to finish up by revisiting the Pass Through Entity Tax (PTET). Notably, while the original version of the OBBBA included provisions that would restrict the utility of the PTET, this was left out of the final version of the bill, and the PTET remains alive and well. Taxpayers who benefit from this generally fall in one, or both of these two categories:

1). Taxpayers who benefit more from deducting state taxes “above the line” than “below the line” (the PTET is an above-the-line deduction that lowers AGI)

2). Taxpayers whose SALT deduction on Schedule A/Itemized Deductions is capped

The OBBBA will reduce the number of taxpayers impacted by #2, but if your income is above $500k, you may be able to deduct more in state and local taxes by taking advantage of PTET provisions. PTET rules are state-specific, so consult your tax advisor regarding how to best manage this.

Putting It All Together

The nice thing about this part of the OBBBA is that compared to the prior rules, this can only help you. However, the enhanced SALT deduction is (for now) temporary, and a savvy taxpayer will note the income restrictions and try to work within them, if feasible. Like many aspects of taxes, the amount of this deduction you take can impact the availability of other potential deductions. One of the key benefits of tax education is that it facilitates taking a holistic approach to your taxes and overall financial situation.