The Self-Employed Physicians’ Guide to the OBBBA Part II: Changes to the QBI Deduction

The new tax bill introduced some changes to the Qualfied Business Income (QBI) deduction (also known as the Section 199a deduction). Taxpayers who work in service professions, such as medicine, have always been eligible for this deduction since it was enacted in the Tax Cuts and Jobs Act (TCJA). However, there are several restrictions on who qualifies for this, and how much of a deduction they can claim. Remember, qualifying for tax deductions is more like winning at limbo than at pole vault. It helps if you can get your income low, rather than high, and this change raises the limbo bar for the QBI deduction another notch or two.

What is the QBI deduction?

The QBI deduction is one of the more complex provisions of the TCJA, and I could write a 10,000 word blog post dedicated to all of its nuances. Put simply, it is a tax deduction for pass-through entities (such as sole proprietorships and S Corporations) that allows them to deduct up to 20% of their business income on their tax return. It is a “below the line” deduction that lowers federal taxable income, but does not lower Adjusted Gross Income (AGI). It also is generally only applied at the federal level, and not at the state level.

For the sake of simplicity, I am only going to discuss how the QBI deduction applies to Specified Service Trades and Businesses (SSTB’s), such as medicine. I will also not get into how the amount of the deduction for S Corps faces a second limitation based on either W2 wages or basis of qualified property (UBIA). You can read all about the special provisions of the QBI deduction here (it’s cheaper than Ambien).

For a quick illustration of how this works, if you have $200,000 of net income from your business and are in the 24% tax bracket, you may be able to deduct up to $40,000 from your taxable income, which would be a ~$10,000 tax savings. However, if your income is above a certain threshold, this benefit starts to phase out, and is eventually lost altogether. Importantly, the phase out range depends on taxable income. This is unusual because the other common cliffs and phase outs that I plan for are based on Adjusted Gross Income (AGI), rather than taxable income.

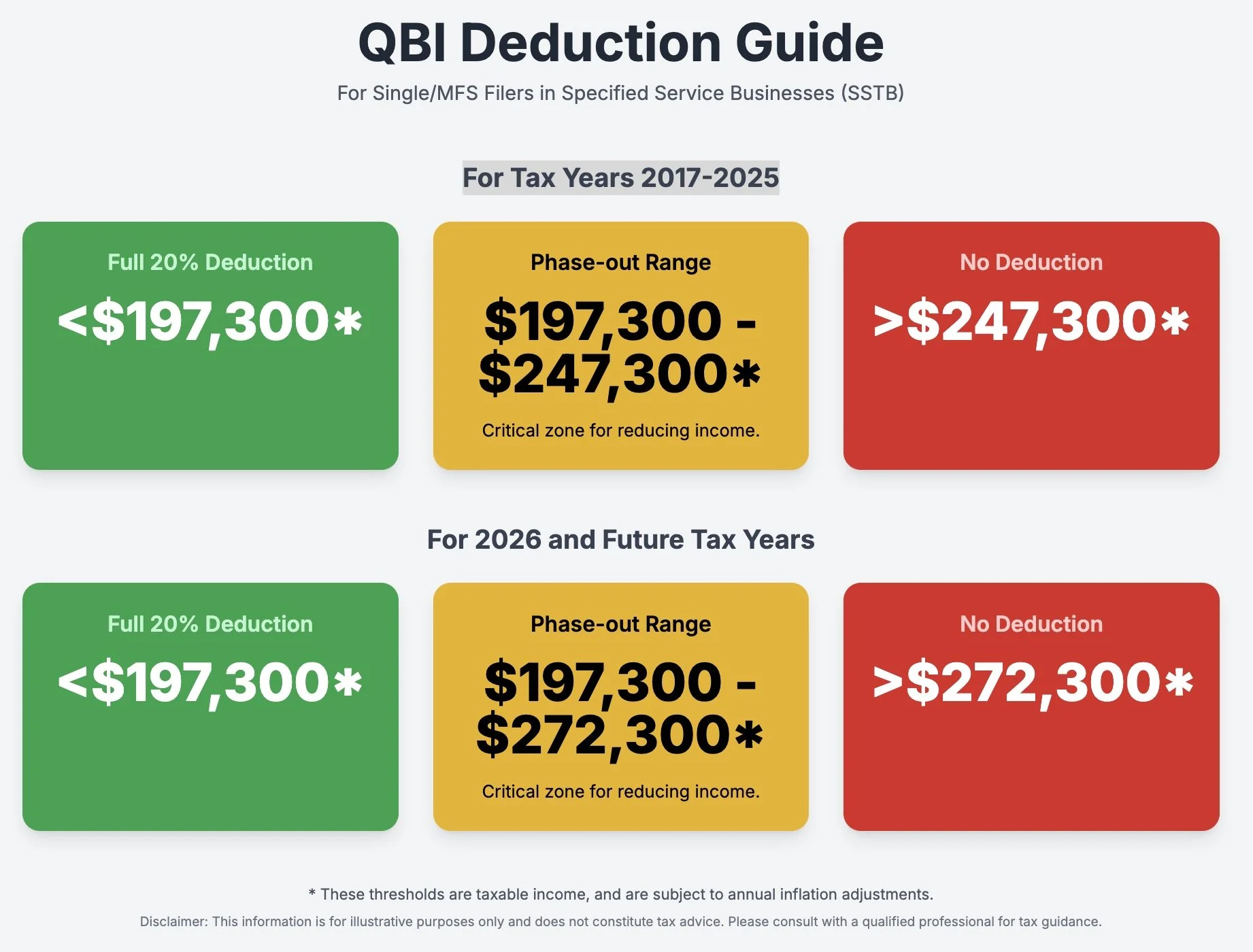

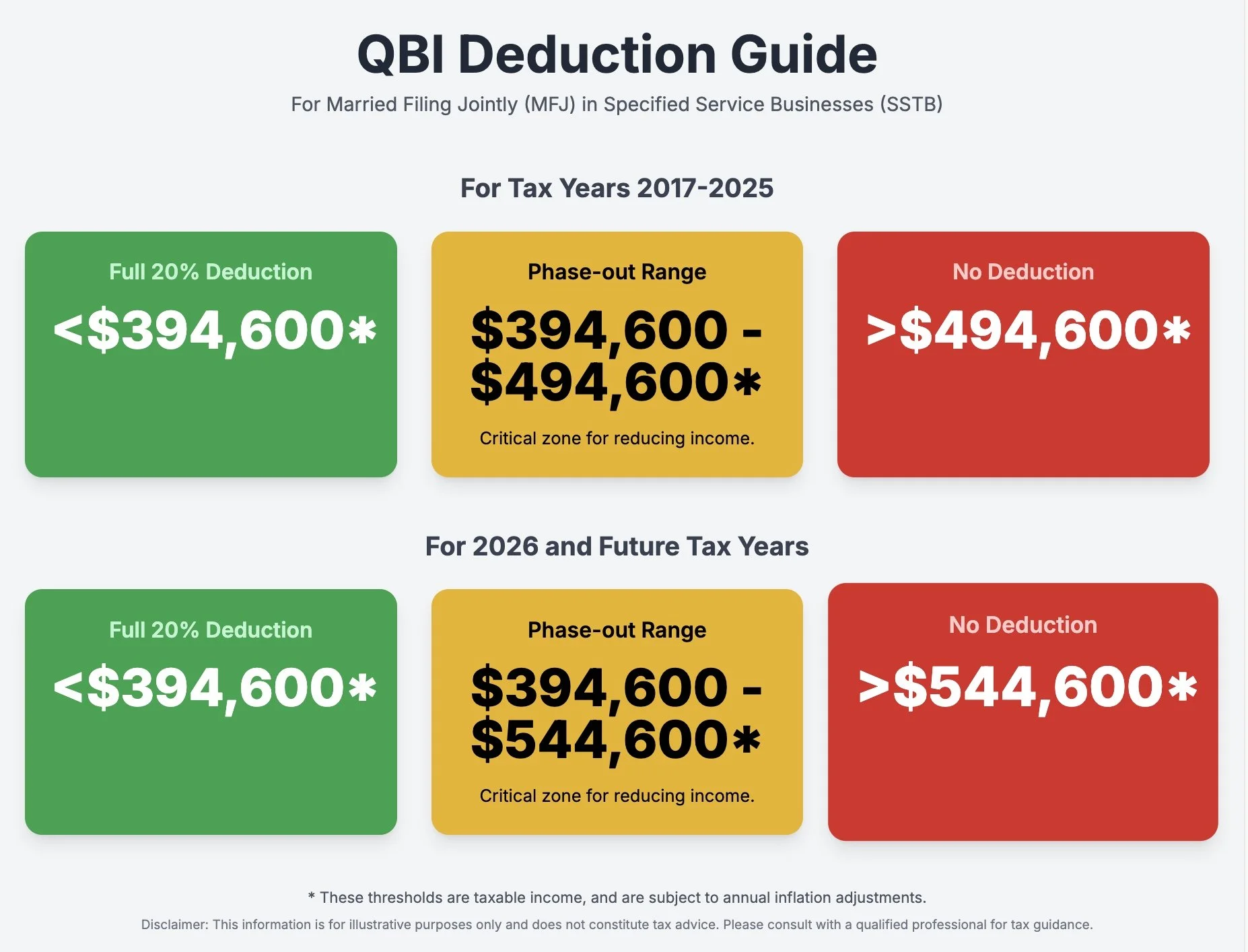

In general, the phase out ranges begin at the lower limit of the 32% marginal tax bracket. For 2025, this is $197,300 for single (and MFS) filers, and $394,600 for married couples filing jointly (these numbers get adjusted annually). The phase out then is assessed over the next $50,000 of taxable income for Single/MFS filers (up to $247,300), and over the subsequent $100,000 of taxable income for joint filers.

As I’ve discussed in prior blog posts, landing in the phase out range of certain deductions and tax credits can massively increase your marginal tax rate beyond the base rate. If you are in the phase out range for the QBI deduction, the impact depends on how much of your income is attributable to your business. I won’t bore you with the math, but if you are married and virtually all of your income is from your business, you could see your marginal tax rate increase from 32% to ~58%!

The big change with the OBBBA is that the phase out range becomes wider. It goes up from $50,000 to $75,000 for Single/MFS filers, and similarly increases from $100,000 to $150,000 for MFJ filers. I have included two diagrams that summarize the income ranges for the QBI deduction, both before and after the OBBBA.

Planning Around the New QBI Deduction Phase Out

As I mentioned earlier, marginal tax rates can increase dramatically in phase out ranges. While this means extra income is heavily “penalized,” it also means that tax deductions that lower income are especially valuable.

It isn’t always feasible to reduce your taxable income sufficiently to take advantage of this deduction. However, this tax break is for business owners, and as a business owner, you have a wide breadth of tax deductions from which you can choose. What makes the QBI deduction even easier to plan around is that it applies to taxable income. We have more levers to lower taxable income than we have for lowering AGI.

One example of low-hanging fruit is increasing your itemized deductions. I’ve written about this in my previous post about the SALT deduction. Of the itemized deductions, you have the most agency over the amount you contribute to charity. While you shouldn’t donate to charity solely for the tax savings (since you only recover a fraction of what you donate), if you are charitably inclined, you might as well time your donations in years in which the tax benefit is optimized.

Making the Most of the Higher Phase Out Range

Here is a simple example of how someone could put their tax education to good use!

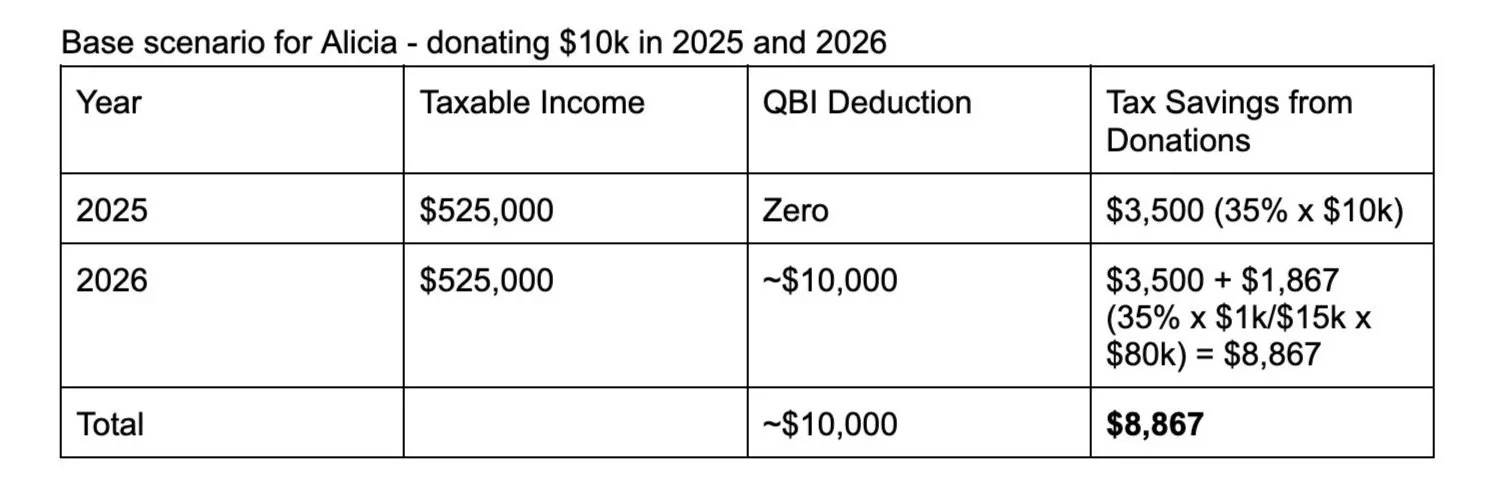

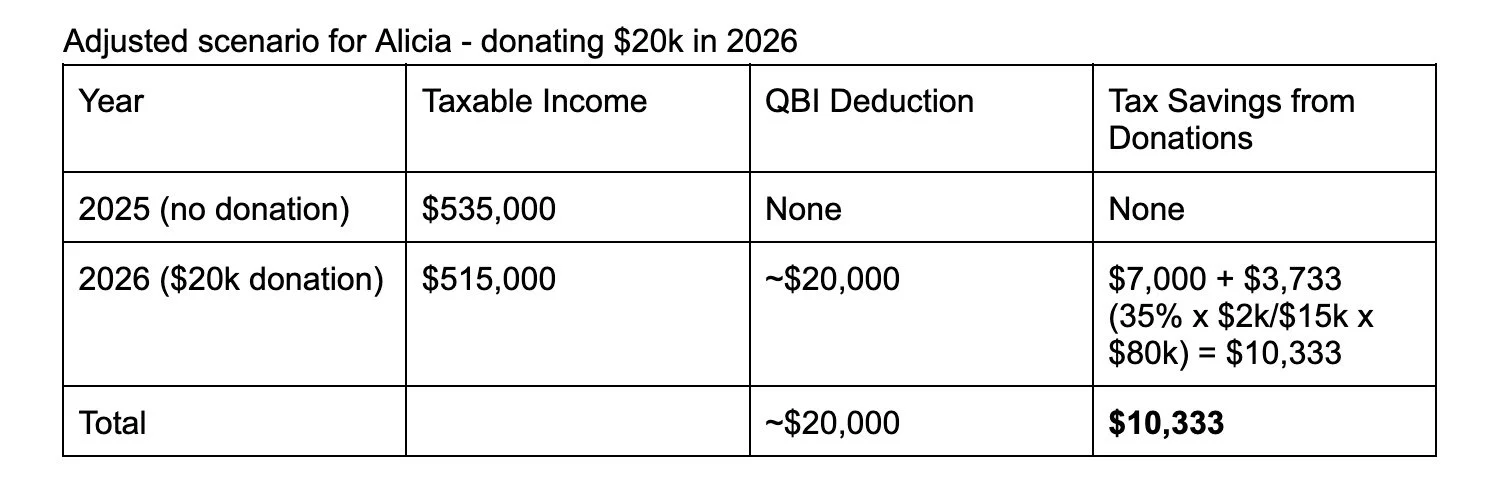

Alicia is a full-time emergency medicine physician who makes about $400,000. She has an S Corporation, and we will assume for now that she pays herself enough in wages to prevent this from limiting her QBI deduction. Her spouse works as an attorney (W2) and earns about $175,000. Their income will be similar in 2026.

Alicia’s Qualified Business Income is $400,000 (and the maximum QBI deduction is $80k). They itemize their deductions and take a $20,000 deduction for State and Local Taxes, $20,000 for mortgage interest, and they donate $10,000 to qualified charities on an annual basis.

In 2025, their taxable income is $525,000 (35% bracket). This is too high for them to receive any QBI deduction for Alicia’s business income. However, with the changes in 2026, they’ll receive part of the QBI deduction.

However, instead of donating $10,000 both years, they could forgo donations in 2025, and then put in two years’ worth of donations in 2026, when they can take advantage of the QBI deduction:

Just by timing a $10k deduction to coincide with the tax “bump zone” in 2026, they save almost $2,000! This is the heart and soul of multi-year tax planning.

How you can use this:

Certainly, this is a change in tax law that is relatively minor, but it has outsized utility for the taxpayers I have the pleasure of serving. Quite a few are in the income range in which it is critical, and it is a special tax break you can receive for the privilege and freedom of self-employment. However, to use it most efficiently, you need to have a pretty solid estimate of your taxable income for the year. Unless you are tracking this diligently and account for everything, your estimates can easily be off by tens of thousands of dollars. This may not be significant compared to your overall income, but it certainly can be critical when it comes to navigating deductions with narrow phase out ranges.