The Accountable Plan: The S-Corp Owner’s Secret Weapon for Tax-Free Reimbursements

If you run your business through an S Corporation, you’ve probably noticed that some expenses blur the line between “business” and “personal.”

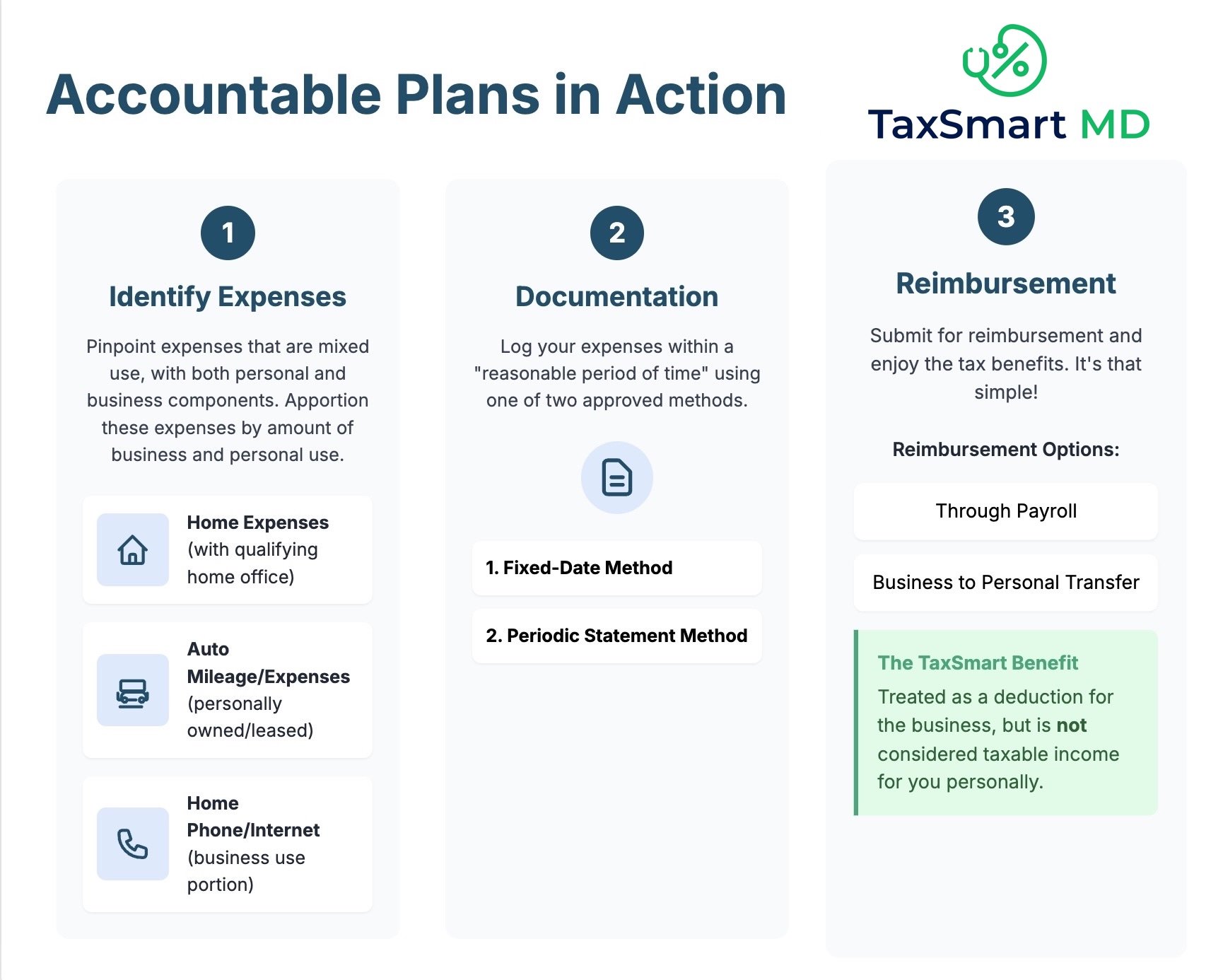

That’s exactly where an accountable plan comes in — an IRS-approved system that lets your S Corp reimburse you for mixed-use business expenses without those reimbursements being treated as taxable income or wages.

When an S Corporation Isn’t the Right Prescription for Physicians

If you’ve spent more than ten minutes in a Facebook group for self-employed physicians, you’ve probably seen this refrain:

“Form an S Corporation — it’ll save you a fortune in taxes!”

Like most good tax advice, it’s sometimes true, but dangerously incomplete.