Navigating the Sunset: Expiring Energy Credits Under the One Big Beautiful Bill Act

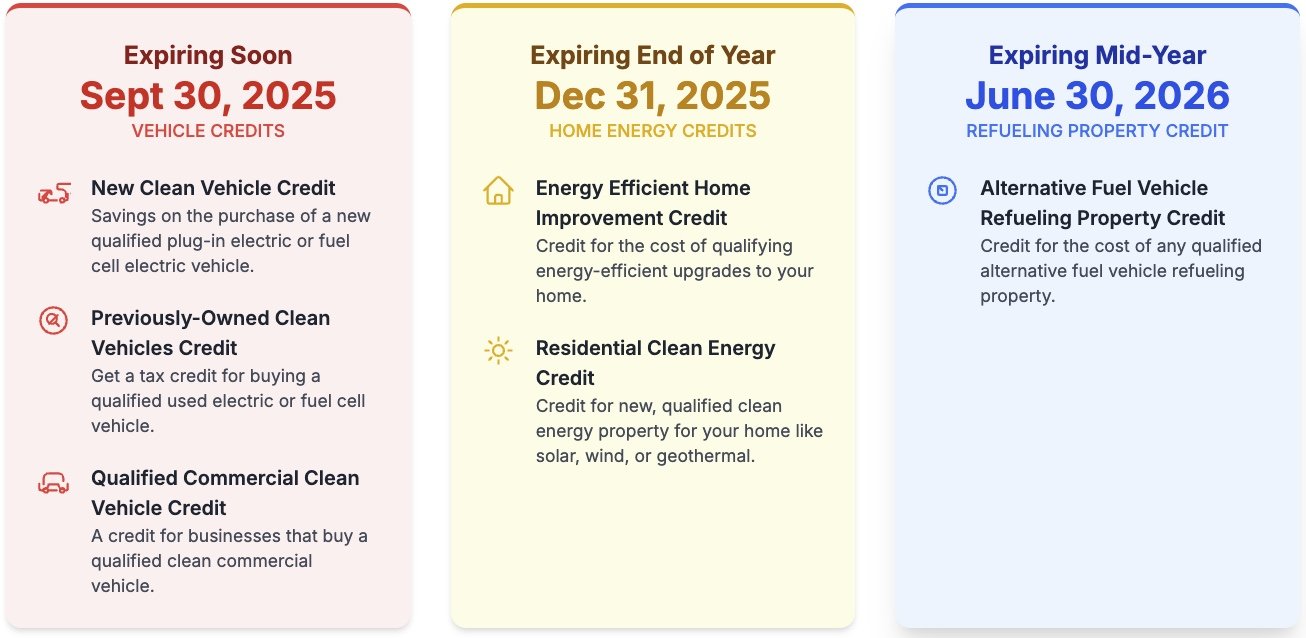

The clean energy landscape underwent a major shift with the enactment of the "One Big Beautiful Bill Act" (OBBBA) on July 4, 2025. This significant piece of legislation brings a number of changes to the tax code, including the expiration of several popular energy-related tax credits for homeowners and consumers. If you've been considering making a green investment in your home or vehicle, it's crucial to understand these changes and the deadlines you now face.

Here, I’ll walk you through the key energy credits that are being phased out, their expiration dates, and what this means for you.

For Electric Vehicles 🚗:

If you've been thinking about purchasing an electric vehicle (EV) or plug-in hybrid (PHEV), the window to take advantage of federal tax credits is closing quickly. The following credits are being repealed:

New Clean Vehicle Credit (Sec. 30D): The tax credit for new electric vehicles is also being repealed. The last day to acquire a qualifying new EV and claim this credit is September 30, 2025. There are several criteria that determine whether the vehicle qualifies for this credit and the amount of the credit. It must undergo final assembly in North America, meet the critical mineral and/or battery components, and must be under a certain MSRP (sorry, Uncle Sam isn’t paying for your Cybertruck!).

Important Note - To qualify for this tax credit, your Adjusted Gross Income must be below the following thresholds:

$300,000 if your filing status is married filing jointly (MFJ)

$225,000 if head of household (HOH)

$150,000 if single or married filing separately (MFS)

Your income must be under these thresholds either in the current tax year (2025), or the previous tax year (2024).

See this link for more information on what qualifies for the credit.

Previously-Owned Clean Vehicles Credit (Sec. 25E): This credit for used EVs will no longer be available for vehicles acquired after September 30, 2025. The vehicle must be priced below $25,000 and must be purchased from a dealer.

Important Note - To qualify for this tax credit, your Adjusted Gross Income must be below the following thresholds:

$150,000 if your filing status is married filing jointly (MFJ)

$112,500 if head of household (HOH)

$75,000 if single or married filing separately (MFS)

Your income must be under these thresholds either in the current tax year (2025), or the previous tax year (2024).

See this link for more information on what qualifies for the credit.

Qualified Commercial Clean Vehicle Credit (Sec. 45W): This credit for businesses purchasing clean vehicles will also expire for vehicles acquired after September 30, 2025. This is a credit for a used or new EV that applies only to the business portion of the vehicle use. The nice thing about it is that, while there are specific criteria the vehicle must meet to qualify for this credit, there is no limitation based on the vehicle purchase price or the buyer’s income. However, the credit will be prorated based on the percent business use of the vehicle.

See this link for more information on what qualifies for the credit.

Alternative Fuel Vehicle Refueling Property Credit (Sec. 30C): This credit for installing home charging stations and other alternative fuel infrastructure will expire for property placed in service after June 30, 2026.

For Homeowners 🏠:

Homeowners who have been planning energy-efficient upgrades will also be affected by the OBBBA. The following residential energy credits are set to expire:

Energy Efficient Home Improvement Credit (Sec. 25C): This credit, which helps offset the cost of energy-efficient upgrades like new windows, doors, and insulation, will no longer be available for property placed in service after December 31, 2025.

You can claim a maximum of 30% of eligible costs, up to a total of $3,200.

$1,200 for energy efficient property costs and certain energy efficient home improvements, with limits on exterior doors ($250 per door and $500 total), exterior windows and skylights ($600) and home energy audits ($150)

$2,000 per year for qualified heat pumps, water heaters, biomass stoves or biomass boilers

Before paying for a project, it is very important to make sure that it qualifies. More information here.

See this link for more information on what qualifies for the credit.

Residential Clean Energy Credit (Sec. 25D): This credit, which provides a significant tax break for installing renewable energy systems like solar panels, will expire for expenditures made after December 31, 2025.

This is 30% of the cost of the new property, but there is no hard dollar cap in the amount of the credit (as there is with the energy efficient home improvement credit).

See this link for more information on what qualifies for the credit.

📅 Key Takeaways

Expiration Dates: Many energy tax credits are set to expire at the end of 2025 or 2026.

Action Required: To take advantage of these credits, ensure that qualifying property is placed in service before the respective expiration dates.

Consult a Tax Professional: Given the complexities of these credits and their expiration dates, it's advisable to consult with a tax professional to maximize potential savings.