Don’t Fall for the “Important New Business Documents” Trap

You might have scary monsters in your professional life, but the Required Documents boogeyman doesn’t need to be one of them.

Starting a new business feels exciting — until the junk mail starts rolling in.

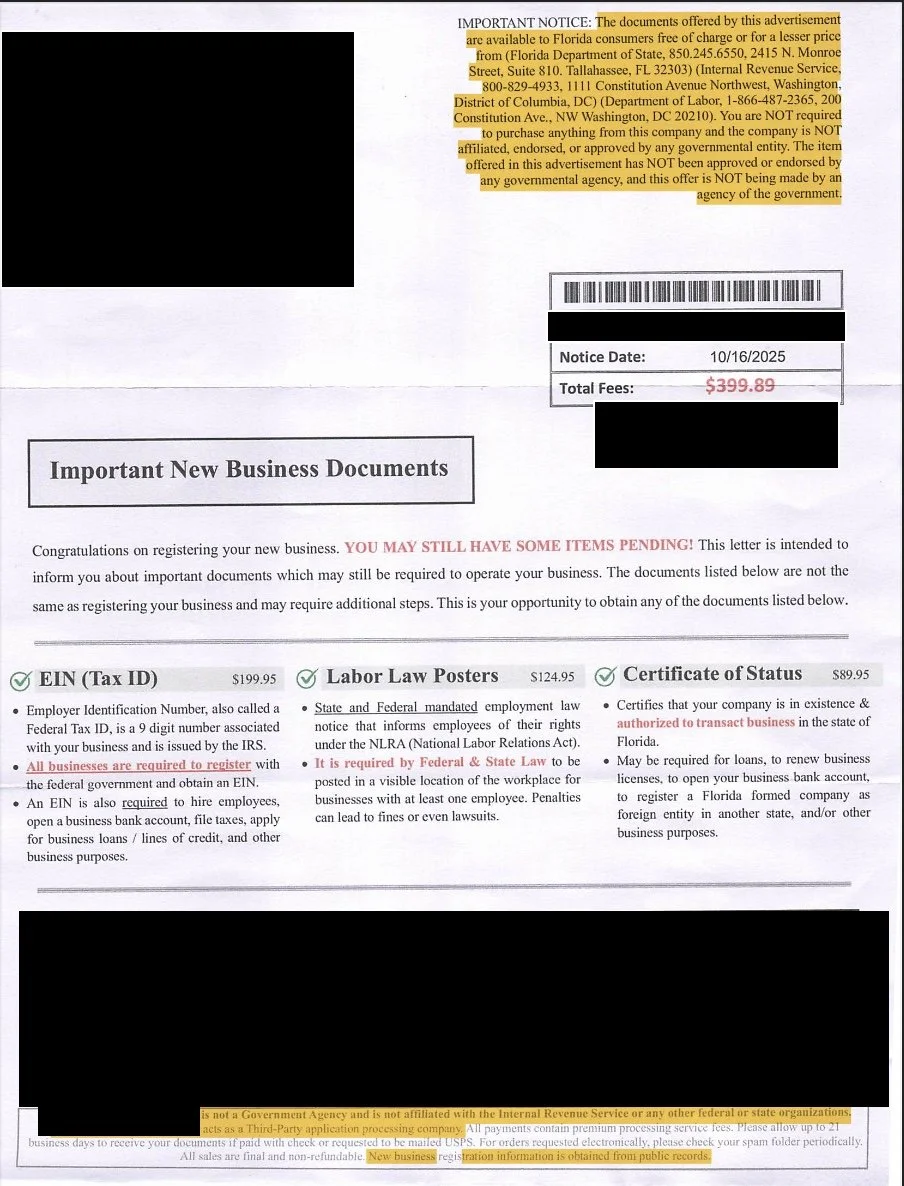

If you’ve recently formed an LLC or corporation, there’s a good chance you’ll receive an official-looking letter like this one. It uses government-style fonts, state seals, and urgent language about “important documents” and “pending filings.” It even includes a due date and a fee total — in this case, $399.89.

But look closer at the highlighted fine print:

“The documents offered by this advertisement are available to Florida consumers free of charge or for a lesser price from the Florida Department of State… The company is NOT affiliated, endorsed, or approved by any governmental entity.”

That’s your red flag.

This isn’t a notice from the state — it’s an advertisement disguised to look like one. These companies know new business owners are anxious about missing a filing or fine. They use that fear and confusion to convince you to pay hundreds of dollars for documents you either don’t need or can get yourself for free.

The Address and the Name Give It Away

If you look closely, the return address on these letters is almost always in a state capital — Tallahassee, Sacramento, Austin — or Washington, D.C. They do this to appear “official.”

Their company names often sound like legitimate agencies — “Business Compliance Division,” “State Record Processing Center,” “Corporate Filing Bureau” — but if you check their websites, you’ll notice something missing:

they never end in .gov.

That’s because they’re not government websites at all. They’re private marketing companies that purchase public business registration data and send mailers designed to look like state correspondence.

What They’re Selling (and What It Actually Is)

1. EIN (Employer Identification Number)

What it is: A 9-digit ID from the IRS used to identify your business for tax purposes.

Who needs it: Any business that hires employees, files certain tax forms, or opens a business bank account.

Cost: Free. You can get it directly from the IRS at irs.gov/EIN.

How long it takes: About 10 minutes online.

These companies charge $199.95 for something you can do yourself — instantly and free.

2. Labor Law Posters

What it is: Required workplace notices explaining employee rights under federal and state law.

Who needs them: Only if you have W-2 employees (not independent contractors or just yourself as the owner).

Cost: Free downloads from the U.S. Department of Labor and your state’s labor department.

When you need them: Once you hire employees and have a physical workplace.

If you’re a single-member LLC or solo professional, you don’t need these yet — no matter what the scary letter says.

3. Certificate of Status (a.k.a. Certificate of Good Standing)

What it is: A document from your state confirming your business exists and is current on filings.

Who needs it: Only if you’re applying for a business loan, registering in another state, or renewing certain licenses.

Cost: Usually $5–$25 directly from your state’s business portal.

In Florida, for example, you can order one instantly from Sunbiz.org for $5. These “business document” companies charge $89.95 for the same thing.

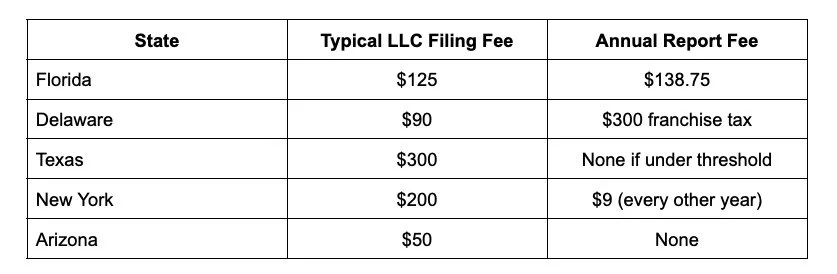

How Much Should It Really Cost to Start a Business?

Forming an LLC or corporation doesn’t have to break the bank.

Here’s a quick overview of typical state filing and annual report fees:

The official cost to start a business is usually under $200, depending on your state — not $399 for a packet of unnecessary “extras.”

Annual Reports: The Only Real Ongoing Requirement

After formation, nearly every state requires an annual or biennial report to keep your entity active.

These are filed directly through the Secretary of State.

Fees typically range from $20 to $150, depending on your state.

You’ll receive official reminders via email if you provided one when you registered your entity.

You don’t need a third-party service to handle this unless you prefer full-service compliance help.

The Bottom Line

When you start a business, your formation details become part of the public record — and marketing companies know it. They scrape those records and send official-looking mail designed to exploit your uncertainty as a new business owner.

Don’t fall for it.

Check the fine print. Verify anything that looks “urgent” through your state’s official .gov business portal, and keep your startup budget focused on what really matters — building your business, not paying for unnecessary paperwork.